how much child benefit and child tax credit will i get

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. This is up from 2115 a week for your eldest or only child in 2021-22.

Here S How To Collect Your Expanded Federal Child Tax Credits Early News Ideastream Public Media

Rates per week 2022 to 2023.

. For each child ages 6 to 16 its increased from 2000 to 3000. If you both claim for the same child only one of you will get Child Benefit for them. However if you are an apprentice with earnings more than the lower earnings limit which amounts to 120 per week or 520 per month applicable for 2021-22 and lesser than.

Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Who qualifies for the GST tax credit. This benefit is designed to help out those who make a low to modest income and is there to help offset the cost of the government sales tax.

Some people receive tax credits from HMRC and other qualifying benefits from the DWP. How much is a Child Tax Credit for 2020. Here is what you need to know about child tax credits Parents with children below age five and younger got 300 each.

If you have one. The maximum weekly childcare costs you can claim for and percentage of costs covered are shown below. The expansion is a part of President Bidens 19 trillion coronavirus aid.

You can only claim Child Tax Credit for children you. Brits will receive their second instalment of 324 between. DWP claimants will receive their second Cost of Living payment by 23 November.

The amount you can get depends on how many children youve got and whether youre. In the 2022-23 tax year youll receive 2180 a week for your eldest or only child and 1445 for any additional children. Adults responsible for children or young people born before April 6.

If youre responsible for any children or young people born before 6 April 2017 you can get up to 3480 a year in child tax credits for your first child and up to 2935 a year for each of your. The maximum amount of the credit is 2000 per qualifying child. Since the maximum benefit for a child.

45000 32797 12203 x 7 85421. Tax credits calculator - GOVUK. 4 Second cost of living.

Many families will soon receive their first payments from a massive one-year increase to the child tax credit. Those with kids between the ages of six and 17 received. As a reminder you must receive Working Tax Credit to receive Child Tax Credit in 2022.

Youll get 550 each month beginning in July through December and then another 3300 when you file your 2021 tax. For 2021 eligible parents or guardians can receive up to 3600 for each child who. A first instalment worth 326 was paid back in July for most households with those on tax credits paid in September.

It has gone from 2000 per child in 2020 to 3600 for each child under age 6. Childcare element of Working Tax Credit. Starting November 4 2022 an estimated 11 million low- and modest-income current GST Credit recipients will automatically receive an additional payment.

To avoid duplicate payments tax credit claimants will receive their cost of living. Claimants must have received a payment - or an annual award of at least 26 for the 2022-23 tax year - from August 26 to September 25. If you have other children who are entitled to Child Benefit youll get 1445 for each child.

How much child tax credits youre entitled to depends on how many children you have and when they were born. The amount you may get depends on the date of birth of your children. If you are eligible to claim child tax credit and your annual household income comes to 17005 or less you may be due the maximum amount of child tax credit.

That means the benefit will be reduced by 85421 which is 7 of their income over the threshold. Child Tax Credit will not affect your Child Benefit. Over 8 million benefit claimants to receive 324 this month as part of Cost of Living support.

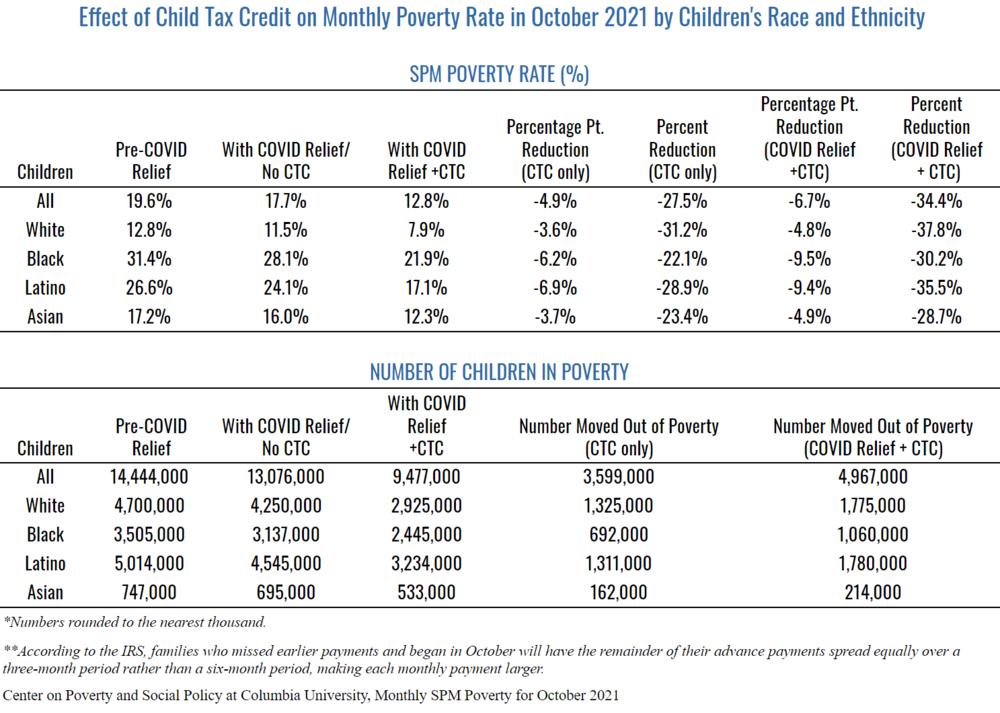

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy

Child Cash Benefit Could Help American Families Now Deseret News

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

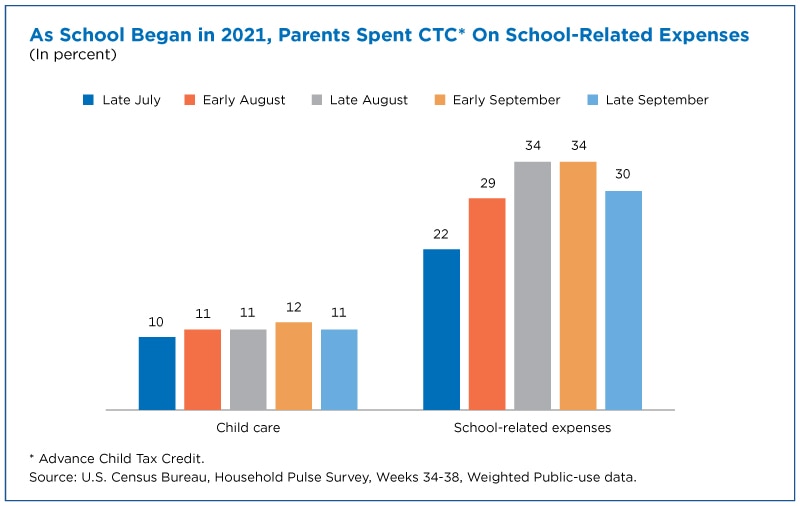

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Monthly Payments For Families With Kids The 2021 Child Tax Credit United For Brownsville

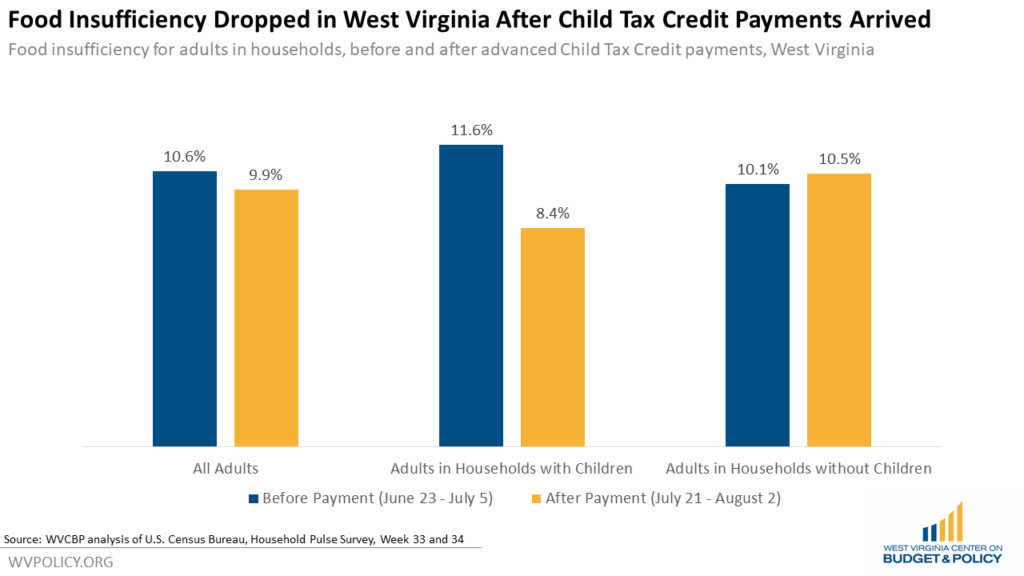

Data Already Showing Positive Impacts Of Child Tax Credit Though More Can Be Done To Ensure Benefit Reaches All Children West Virginia Center On Budget Policy

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

How Families Will Spend The Stimulus Bill S New Child Cash Benefit Npr

White House Promotes Use Of Tax Credits For Parents And Employer Paid Leave

Democrats Further Effort To Expand Child Tax Credit For Pandemic Relief

When Families Do Well America Succeeds Make Expanded Child Tax Credit A Permanent Benefit The Seattle Times

The Tax Break Down Child Tax Credit Committee For A Responsible Federal Budget

Child Tax Credit Payments 2021 Who Is Eligible And How Much Are They Wsj

How Can Children Benefit From The Us Child Tax Credit In The Future Humanium

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

Raising Kids Is Expensive Relief Is Here Empire Justice Center

The New Child Tax Credit Does More Than Just Cut Poverty

Child Tax Credit Enhancements Under The American Rescue Plan Itep